TAX CREDIT PROGRAM FOR BUSINESS DONORS

CDFA’s Tax Credit Program awards approximately $5 million in tax credits annually in a competitive grant round. The program aims to support organizations that are engaged in community economic development initiatives that show a high degree of community support, build partnerships and leverage other resources.

CDFA’s Tax Credit Program awards approximately $5 million in tax credits annually in a competitive grant round. The program aims to support organizations that are engaged in community economic development initiatives that show a high degree of community support, build partnerships and leverage other resources.

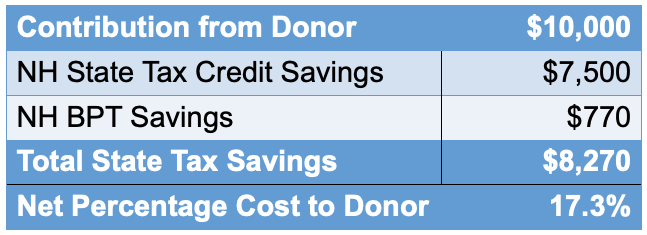

Grants made to eligible projects are in the form of tax credit equity. Businesses with New Hampshire tax liability support awarded projects by purchasing the credits, resulting in the nonprofit receiving a donation and the company receiving a 75 percent New Hampshire state tax credit against that contribution. The credit can be applied against the Business Profits Tax, Business Enterprise Tax or Insurance Premium Tax. The donation may also be eligible for treatment as a state and federal charitable contribution.

New Hampshire businesses value this unique state program which incentivizes public-private partnerships to fund local initiatives. By participating in the Tax Credit program, business’s donations stay in their communities and help establish strong relationships with local nonprofits.

The value of the tax credits are maintained in the state economy and, according to economic analysis, magnified by a factor of almost 2:1. The Tax Credit program helps a participating company significantly increase its community impact by leveraging tax dollars. For example, a business can make a $10,000 impact on the local community for a net cost of $1,710.

The value of the tax credits are maintained in the state economy and, according to economic analysis, magnified by a factor of almost 2:1. The Tax Credit program helps a participating company significantly increase its community impact by leveraging tax dollars. For example, a business can make a $10,000 impact on the local community for a net cost of $1,710.

To help businesses participate in the Tax Credit program, CDFA provides resources to evaluate donation opportunities, including background on projects currently fundraising, a tax credit calculator to estimate the return-on-investment for a donation, as well as an Overview of the CDFA Tax Credit Program and Tax Credit Frequently Asked Questions.

The donation process is simple and flexible with an online pledge system.